What is your net worth?

If you asked me that question 5 years ago, I’d have thought you were crazy. Broke people don’t have a net worth, right?

I’d have also immediately thought of Warren Buffet, Oprah Winfrey, Jeff Bezos, Chris Kirubi, Beyonce’… because to me, some games are reserved for the wealthy.

But that was 5 years ago! I now update my net worth spreadsheet every month and you should too!

As a personal finance coach, one of the first questions I ask my financial coaching clients is “What do you own and why?” This helps me to establish:

- How many assets they own and their value.

- How much debt they’re carrying.

- Why they own the assets (how the assets are helping them achieve their financial goals)

I use the data to calculate their net worth.

How to calculate your net worth: Net Worth Formula

Your assets – your liabilities = your networth.

What is an asset? A resource that you own. Something useful or financially valuable.

Liability is what you owe, such as debt.

Simply, your net worth is what you own minus what you owe.

Examples of Assets

Examples of assets include:

- Current and savings account balances

- Fixed-income securities (Treasury bills & bonds)

- Real estate (land, rental properties, a home etc)

- Vehicles (you need to get the current market value)

- Equity Securities (shares)

- Commodities such as gold etc

Examples of Liabilities

Examples of liabilities include debts like:

- Mortgage

- Credit card balances

- Student loans

- Car loans

- Rental arrears

- School fees arrears

Your net worth includes the current market value of assets and the current debt costs.

Positive net worth

If your assets minus your liabilities equal a positive number, you have a positive net worth.

Example: $6,000 worth of assets minus $4,000 worth of debt = $2,000 in net worth.

In this case, what you own is more than what you owe.

If your assets minus liabilities equal zero, that’s also a positive net worth.

Example: $6,000 worth of assets minus $6,000 worth of debt = $0 in net worth.

What you owe is equal to what you own

Negative net worth

If your assets minus liabilities equal a negative number, you have a negative net worth.

Example: $4,000 worth of assets minus $6,000 worth of liabilities = -$2,000 in net worth

What you owe is more than what you own.

One of the best ways to change your net worth from negative to positive is by paying off debt. I have written many guides on debt payoff strategies that you can find here.

It’s that simple.

It can be a very anxiety-inducing and embarrassing exercise if you think your net worth is 0 or negative. It’s worse if you start thinking that you haven’t achieved a certain financial milestone at your age.

Unfortunately, the world we live in equates our net worth to our self-worth. As much as building wealth is important due to the security it provides, you shouldn’t equate your self-worth to your net worth. You’re a valuable human being irrespective of what you own or owe.

I enjoy looking at my net worth spreadsheet (which I’ll get to in a bit) and sometimes I worry that I’m worth too little, but I never equate that spreadsheet to my self-worth.

Example of Net Worth

Consider a couple with the following assets:

- A home valued at $150,000

- A balanced investment portfolio with a market value of $190,000

- Cars valued at $11,937

They also have the following liabilities:

- An outstanding mortgage balance of $50,000

- Student loans of $7,856

The couple’s net worth adds up to:

[$150,000 + $190,000 + $11,937] – [$50,000 + $7,856] = $294,081

They have a positive net worth.

Since we agreed that you should update your net worth spreadsheet regularly, let’s see how their financial position changes 5 years later:

Their home value changes to $225,000, their investment portfolio reduces to $120,000 and the value of their cars reduces to $7,000. For their liabilities, they reduced their mortgage loan to $10,000 and paid off their student loans.

Their net worth five years later would be:

[$225,000 + $120,000 + $7,000] – $10,000 = $342,000

Why is your networth important?

From years of experience as a personal finance coach, I have learnt that a person can have a big paycheck but a very low net worth if they spend most of their income. Yes, high-income earners can also live paycheck to paycheck.

I have also interacted with people with modest incomes, but who have built significant wealth through investing in appreciating assets and have a high net worth because they’re prudent savers.

1. Knowing your net worth is like getting a financial report card

If you realize that your assets are more valuable than your liabilities, you can pat yourself on the back because you are (probably) doing well financially. If you have more liabilities than assets, then you can plan to reduce your liabilities.

2. Use it to measure your financial wellness

As we’ve established, your net worth doesn’t depend so much on how much you make but more on how much you keep(invest). By calculating your net worth, you can compare how well you’re doing every month.

A life hack: instead of getting stuck comparing yourself with other people based on their cars, iPhones, latest gadgets, where they live, how they dress etc, always remember that those flashy possessions are not a true reflection of their financial wellness. Unless you know someone’s net worth, you don’t know how well they’re doing financially.

Calculating your net worth will help you ensure you’re on track to meet your financial goals.

3. Financial institutions ask for the data

Some financial institutions evaluate whether they can give you a loan based on your net worth. Your net worth is a reflection of your ability to repay the debt in case of default: they can liquidate some of your assets to recover their money.

4. Used when drafting prenuptial agreements.

For example, I have a coaching client who has an agreement with the husband that any assets they each acquired before marriage would remain in their individual names and any properties acquired while married, would belong to both of them.

5. Knowing your net worth is an important part of retirement planning

How much are you worth now? How much will you need when you’re retired? How will you fund your life when retired?

You need to know these figures in order to plan for your retirement.

How to track your net worth

1. Set a calendar reminder

One of the things that makes life easier and helps in solidifying positive habits is using Google calendar to set up reminders. How is tracking your habits coming along btw?

When I learnt about tracking my net worth, I set up a monthly calendar reminder that reads ‘Agatha, what is your net worth?’ Every end month, my phone will buzz and I’m forced to think about how I’m doing financially.

2. Update your spreadsheet regularly

Here is how my simple Assets spreadsheet looks like:

For some assets such as a house or land, you wouldn’t know the value outright. For such, you can consult a property valuer or use historical costs (how much it cost you to build or buy) or how much on average your house would cost in the current market.

For items such as televisions, premium furniture, household electronics and such, you can choose to either ignore them and not include them in your assets sheet or establish a floor value. For example, if an item is worth x amount in value and above, include it. If less than that x amount, exclude. I don’t include such items in my net worth sheet.

My investment 2 above is stocks. To update it, I usually request a Portfolio Valuation Report from my broker. This is a report that shows the value of my stocks which is dependent on the loss or profit gained.

For the other three investments, I receive monthly statements. I update the spreadsheet when I do.

The rest of the assets are in hard cash at the moment and are updated when I make deposits.

For my liabilities, I have one debt. The mighty student loan debt (Higher Education Loans Board). I currently owe exactly $1,880. Very proud of myself because I crossed the above $2,000 mark. And I’m consistently paying on a monthly basis.

Update: I paid off my HELB loan and attained debt freedom on Thursday, 8th April 2021 at 1505 hours! You can my story here!

My assets-my liabilities = a positive number 🙂

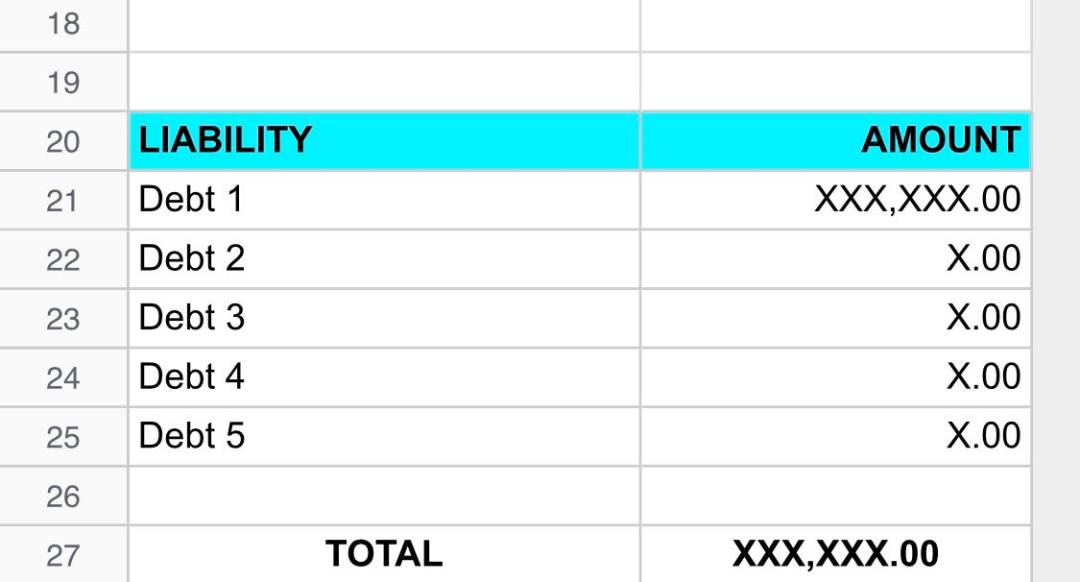

Use a simple spreadsheet such as the one below to track your liabilities.

3. Have specific financial goals

Saying ‘I want to be rich’ or ‘One day I will be rich.’ is not a goal. Fantasizing about your future wealth (as much as I do it a lot too) is not a goal. Sorry!

To be worth an X amount by 31st December 2020 is a goal.

When 2020 began, I told my two girlfriends that by 31st December 2020, I will be a solid millionaire. I know I like using $ when talking about money here because I have international readers, but this millionaire goal was in Kenyan shillings.

When I told them that, I didn’t know how I was going to do it. However, I was willing to put in the work. Most importantly, I was willing to bet on myself and my ruthless appetite for reading and upgrading my skills.

Update: I achieved millionaire status before the end of 2020! 😁

What is your specific net worth goal?

Key tips and lessons on how to grow your net worth

1. Don’t worry if your net worth is 0 or negative especially if you’re still in your 20s

The book A Simple Path to Wealth by JL Collins taught me that there are two stages in our investing lives: The Wealth Accumulation stage and The Wealth Preservation stage.

The Wealth Accumulation stage is when you’re working and have earned income to save and invest. I can bet that 99% of my readers are in this stage. Focus on learning ruthlessly, upgrading your skills, building (a business, a craft, investments etc), living within your means and paying off debt.

It’ll take years for most of what you build to pay off. Be patient.

Some people might be incurring more debt at this stage if they take a loan to start a business or finish their studies.

Point is, this is the stage to focus on building.

Having a 0 or negative net worth is not wrong. But having a 0 or negative net worth and also zero knowledge when you have access to the internet? That’s doing yourself an injustice.

Don’t judge each day by the harvest you reap but by the seeds you plant. — Robert Louis Stevenson

2. Cultivate an attitude of deservedness

One of my favourite personal finance podcasts is Mastercard’s Fortune Favours the Bold hosted by Ashley C. Ford. In one of the episodes, one of her guests said…

“Entitlement isn’t always bad when it’s in the service of love of self as opposed to the degradation of others. Have a feeling of deservedness as opposed to ‘I’m lucky enough to get a shot, I need to prove myself to this committee.’ Some people are born in a default of ‘I deserve’ while others are not. Even if you don’t have the financial resources, feel that you deserve. It makes you strong and grounded to go out and get. Be shameless in your ability to express desire.”

Honestly, I used to be one of those ‘I’m lucky enough to get a shot’ ‘I need to prove myself to this committee’ people all my life which is why that quote deeply spoke to me.

I got over that self-defeating mentality by going to therapy.

The speaker also mentioned that this mentality is mostly common among people who grew up poor and they often need help to get over the mentality.

3. Work on reducing your liabilities

Budgets are liberating. They allow you to prioritize and tell your money where to go.

To move from a negative or zero net worth, one of the key items in your budget should be debt payment.

Here is a simple step-by-step guide on how to build a budget

4. Increase your ability to earn more

Take a new course. Upgrade your skills. Negotiate for a raise. Start a side hustle. Invest a part of your paycheck to build passive income streams.

Have a deliberate plan on how you plan to increase your ability to earn in the next 6 months.

A pitcher can be filled drop by drop and so is the case with your wealth. Acharya Chanakya

5. Be consistent, be patient

Your net worth is dependent on how much you save and invest. And the growth of your investments is dependent on the magic of compounding. Don’t interrupt your compounding.

Better still, don’t focus on winning small financial battles and end up losing your financial war. What do I mean? Read my 2 part series on it:

Losing the battle winning the war 1

Losing the battle winning the war 2

Always make sure that you spend less than you earn.

6. You are a business one one

Remember that you can’t manage what you can’t measure. You should always know your net worth at any point in time to know if you’re making progress or not.

Take yourself seriously. Be hands-on about your financial health.

You’re so broke you don’t think you should budget and bookkeep? False. You gotta value your brokenness the same way the rich value their wealth. Don’t take pride in it, but value it and take accountability for why you’re broke and how you gon climb out of it. — Financial Philisopher on Twitter

7. Avoid big financial losses

Rule number 1: Never lose money.

Rule number 2: Don’t forget rule number 1.

— Warren Buffett.

8. Talk to your partner about your net worth goals

You’ll end up resenting your partner if you decide to build your net worth without communicating the same with your partner.

I’ve experienced situations where one partner works super hard to build their net worth whereas the other one is stuck on their bad spending habits. While one is busy filling their assets column, the other is busy spending it or filling their liabilities column.

Solution? Communicate with your partner. Have money dates 🥂

What is a good net worth? What makes a good net worth?

The above image shows you the level of wealth (net worth) you need to join the 0.1% in selected countries.

To determine a good net worth for you, you need to start by having clarity on what you want out of your life. A good net worth is one that allows you to achieve your definition of financial freedom, one that gives you options and the flexibility to live your life comfortably.

“It’s about the experiences you want to have and the freedom to pursue those experiences,” Todd Tresidder

Does networth mean rich?

No! You now know that your net worth is your assets minus your liabilities. You can use the image shared above to check how far you are from being among the top 0.1% of wealthy people in your country. The more you build your net worth, the closer you get to your ‘rich’ goal!

Once you make tracking your net worth a habit, it becomes a rewarding experience to look back on your journey. It’s also exciting to watch as the figures go up and down.

So, how much is your net worth? Take time and fill out the spreadsheet. I can help you through this process if it sounds daunting. Halla: agatha@thewealthtribe.com

And remember that your net worth does not define you as a person. Take control.

Subscribe to my blog to receive more gems every Thursday!

Latest posts by Agatha (see all)

- How The Vuka Investment Club Platform Works + How To Buy And Sell Units Of The Acorn I-REIT On The Vuka Platform - July 19, 2023

- How To Use Cashlet App To Create Sinking Funds For Beginners In 5 Easy Steps - July 7, 2023

- June 2023 Infrastructure Bond: Bond Redemption Structure & Amortization - June 12, 2023

- What Is Your Net Worth? How To Calculate Your Net Worth In 2 Easy Steps & Why It Matters - April 13, 2023

0 Comments