In the last article on how to invest in Treasury Bills, we learnt that there’s a different way you can contribute towards funding government projects apart from through paying taxes. This is through investing in fixed income securities.

As shown in the flow chart above, there are two types of Fixed Income Securities:

- Treasury Bills

- Treasury Bonds

They’re referred to as fixed-income securities because the return the investor gets is usually paid out in fixed interest payments on fixed dates over a fixed period of time.

The key differences between T-Bills and Bonds

Treasury bonds can also be sold at a discount, at par or at a premium. You’ll know what all these mean by the time you’re done reading this guide.

For the ultimate guide on how to invest in Treasury bills, click here.

In this article, you will learn everything you need to know about Treasury Bonds.

Treasury bonds definition

A bond is a debt security.

The authorized issuer owes the holders (investors) a debt. The issuer is obliged to pay interest on the debt.

Treasury bonds are debt securities issued by the government.

In Kenya, Treasury bonds are issued by the government through The Central Bank of Kenya (CBK).

Types of Treasury Bonds in Kenya

There are different types of treasury bonds classified depending on the purpose of the bond and the structure of the interest rates.

Here is a low down on the bonds to expect across the investment spectrum in Kenya.

1. Fixed coupon or rate bonds

The rate of interest or coupon is fixed over the life of the bond

2. Zero-coupon bonds

These bonds do not pay interest but are usually sold at a deep discount and redeemed at par. The difference between the discounted price and the redemption price is your return.

3. Floating rate bonds

These are bonds whose coupon rate varies depending on the prevailing market conditions

4. Infrastructure (specific project) bonds

These are bonds issued purposely to help the government raise money to fund infrastructure projects across the country. A good example is the M-Akiba bond.

5. Restructuring or special bonds

These are bonds issued to help the government recapitalise or pay off maturing debt. Special bonds are issued for a specific purpose such as funding a designated hospital or railway project.

6. Amortized & Savings development bonds

These bonds are mostly issued for budgetary support

Having said that, the Central Bank of Kenya predominantly issues fixed coupon bonds and infrastructure bonds.

How often are Treasury bonds issued? How often are treasury bonds auctioned?

Bonds are auctioned by the Central Bank of Kenya on a monthly basis.

Sometimes they issue special bonds on a need basis. For example, sometimes they reopen old bonds that had been issued previously to raise more money. For a reopened bond, the bond is auctioned and would in most cases result to a different yield and hence a different price than the initial time it was auctioned.

There’s also a tap sale which is a kind of bond where the bond on offer is not auctioned but sold based on yields of the just concluded auction of the bond.

How many Treasury bonds can you buy?

You need a minimum of KES 50,000 to start investing in bonds.

Understandably, this is a large amount of money especially for a beginning investor which poses a barrier to entry unlike investing in Money Market Funds where you can begin investing with as little as KES 2,500.

If you cannot raise the KES 50,000 or 100,000 for infrastructure bonds, don’t despair. Baby steps are the way to go! Start with a Money Market Fund then onboard Treasury bills & bonds in your investment portfolio later.

Note: Aside from Money Market Funds, you can invest in Bond Funds or Balanced Funds as these give you more exposure to treasury and corporate bond instruments.

I will do a follow-up article on Bond Funds and Balanced Funds later.

How do Treasury bonds work in Kenya?

The government through the National Treasury comes up with the budget estimates for the fiscal year showing projected revenue and expenditure. Almost always, the planned expenditure exceeds the projected revenue mainly from taxes. The deficit is usually plugged through domestic and international borrowing.

Treasury bonds are a way of raising the domestic share of funds to support the budget.

Both institutions and individual investors can subscribe to bond issues by lending the government money with a promise to get a return every 6 months and the principal at the end of the bond term.

Why does the government issue Treasury bonds?

The government issues bonds as a way to raise money to fund its various projects.

If you ever read the government budget, issuance of T-bills and T-bonds is collectively referred to as domestic borrowing by the government.

What are the rates for treasury bonds?

The coupon rates of interest are determined by CBK and they vary depending on how desperate the government is in need of funds.

Also, the prevailing interest rates and the tenor (time/duration) of the bond play a key role in determining the rate of interest. Most bonds give between 11 and 14% in interest paid semi-annually.

How to buy treasury bonds in Kenya

To buy Treasury bonds, you need a Central Depository for Securities (CDS) account maintained at the Central Bank of Kenya.

https://www.youtube.com/watch?v=P12Ge8A83hQ

This is different from the CDSC (Central Depository Securities Corporation) account that you need to buy equities/shares.

Requirements for a CDS account

1. Complete a CDS account application (referred to as a Mandate Card) form issued by CBK.

You can get this form from any CBK branch countrywide. You can pick this card from the branches on any weekday before 2 pm.

2. One recent coloured passport size photograph.

The back of the photograph MUST be certified by your Banker and stamped. The passport photo shouldn’t be stapled or glued to the card.

3. The original and clear ID or passport copy or alien certificate.

CBK will retain the copies.

4. A signatory

Your banker should witness and confirm your signature on the mandate card. He/she should also stamp and sign your mandate card.

Central Bank Guidelines for filling the CDS application form (Mandate card)

- Should be filled in BLOCK LETTERS in a neat and clear manner.

- Names must be written in the order they appear in your identification document.

- There should be no corrections or errors.

- Don’t fold the card or disfigure it in any way.

- For a joint account:

- Each applicant should fill the application form (mandate card).

- All signatories are required to appear in person and sign the card in the presence of a designated CBK officer or authorised agent.

- All other guidelines above apply to joint account applicants.

Can you get a second form if you mess up one?

When you go to CBK, collect at least 3 forms so that you have an extra one if you mess up. You can also share the other forms with your family, friends or colleagues. Wealth building is better when your whole tribe is winning!

How to open a CDS account

1. Return the filled mandate card and the documents to CBK.

You’ll be directed to a counter where your application will be received by an officer and checked for compliance.

2. Once your account is set up, you will be sent an email by the National Debt Office which reads like this:

Dear Investor,

CONFIRMATION OF UPDATE ON CDS ACCOUNT

We have processed your application for amendment of your CDS account details held in our books as per your recent request and confirm that we have affected the changes as requested.

CDS/PORTFOLIO ACCOUNT NO. 123454-1

VIRTUAL ACCOUNT NO. 1000259781

Please note that CDS accounts without balances for a period of one year automatically become dormant.

When transacting always quote CDS/Portfolio account number in Treasury Bill/Bond primary tender applications or any other correspondence. Also while making payments for investments in Government Securities, send the funds to your Virtual account number as given above.

In the event of any change in your bank/branch details or reactivation of a dormant account, you are required to complete new mandate cards to effect the change in your CDS account.

Yours faithfully,

CDS SECTION

Monetary Operations & Debt Management (MODM)

Financial Markets Department

Central Bank of Kenya

It takes 7 working days to process your application at the CBK.

Note: To prevent your CDS account from becoming dormant, ensure that there is always a security (either T-bill or T-bond) running in your account.

Where to buy Treasury Bonds in Kenya

Once your application is approved, the next step is to start investing in Treasury bonds. There are two ways you can buy Treasury bonds:

- Directly through the Central Bank of Kenya (manually or through CBK-TMD USSD Application)

- Through approved investment companies such as

- Commercial banks

- Non-bank financial institutions

- Licensed stockbrokers

- Licensed investment advisors.

These investment companies charge you management fees (a portion of your investment capital).

A smart investor breaks the chain of going through intermediaries which is why investing directly through CBK is the best option and the only option we’ll teach you in this article.

Here are the steps to follow when investing through CBK.

Step 1: Check the Treasury Bonds on offer on the CBK website.

Remember that these are auctioned on a monthly basis so they keep changing. Check here.

The screenshot below shows one of the Treasury bonds that was on offer in March 2021 (at the time of publishing this article).

Page 1:

Treasury bond prospectus

How to interpret a bond prospectus

The above document usually has a lot of technical terms which might be intimidating for first-time investors.

I’ll break down what each of the terms mean so that when you’re ready to invest in the upcoming bonds, you’ll know exactly what you’re getting yourself into.

1. On the right-hand side, you’ll see that the bond is described as ‘prospectus for re-opened…’

Re-opened simply means that it’s an old bond that had been previously issued. The government has reopened it to raise more money.

The above document is unique in that it has 2 bonds. A 10-year and 20-year bond.

2. Fixed coupon treasury bond

Coupon rate means interest rate. A fixed coupon treasury bond means that the interest rate that you’ll be paid on your investment is fixed and guaranteed.

For example, the 20-year bond above has an interest rate of 13.2%. You’re guaranteed a 13.2% interest rate for 20 years. This is one of the reasons why investing in Treasury bonds is a lucrative and predictable investment.

3. FXD1/2019/10 AND FXD2/2018/20

Every bond has a special code that’s used to identify it.

In the screenshot above from the CBK website, the issue numbers of the 2 bonds are FXD1/2019/10 and FXD2/2018/20

4. Total Value: KES 50 Billion

This is how much money the government is seeking to raise through the two bonds.

The above is a March 2021 issue.

Let’s explore the left-hand side of the prospectus…

1. Yield (YTM)

Yield to Maturity (YTM) is the total percentage return you’ll get if you hold the bond to maturity. That is, to the very end of its term. You’ll notice that the Yield to Maturity is slightly different from the coupon rate.

This is because YTM takes into account the semi-annual interest you’ll be getting plus the price differential between the purchase price at the beginning and the par value that the government will redeem the bond at when it matures.

2. Clean Price

New or primary market issues normally have only one price and that is the clean price. This is the price of the bond less any accrued interest.

Normally when bonds start trading and you buy them in the secondary market, you normally get quoted a “DIRTY PRICE’’. This is because you could be buying the bond in month 4 and it pays interest in month 6. The price will therefore include the 4 months of accrued interest.

Page 2:

Treasury bonds prospectus

The first thing you see on page 2 is the identifier of the bonds.

Below that we have the terms of the bonds.

1. Issuer

The Republic of Kenya. It is a bond issued by the government of Kenya.

2. Amount

How much the government is seeking to raise.

3. Purpose

For the above bond, the purpose is to raise money to supplement the government budget.

3. Tenor

This is the lifespan of the bond.

The above bonds are old bonds, you’ll see in brackets the number of years left before the two expire.

For the 10 year bond, 8.0 years are left.

4. Coupon Rate

This is the interest rate, per annum.

The 20-year bond above has an interest rate of 13.2% which makes it a lucrative investment.

5. Period of Sale

This is the period of time CBK will be accepting applications to invest.

The above was open between the 1st and 9th of March. That means you can no longer invest in this specific one, you have to wait for the next auction.

6. Value Date

If your bid is accepted, the value date is the deadline for when you’re supposed to send your money to CBK.

7. Price Quote (Discounted, Premium, Par)

Discounted pricing means that you are paying less than the face value of the bond.

Upon successful bidding, you may be told to pay 98,562 for a Ksh. 100,000 bond. This means for every 100 you are paying 98.562. At maturity, you’ll be given not the 98,562 that you invested but 100,000.

Premium is the opposite of discounted bonds. For instance, you may be told to pay 102,000 for a 100,000 bond. This means for every 100 you are paying 102. At maturity, the government will pay you 100,000 and not the 102,000 that you paid.

Buying a bond at par means you are paying the exact face value. For a 100,000 bond, you’ll pay 100,000 and at maturity, you’ll get back your 100,000. The only return here is the coupon interest.

8. Minimum amount

The smallest amount you can invest. For the above bonds, the minimum is KES 50,000.

9. Interest payment dates

Specific dates you expect to receive your interest payout from the Central Bank. The interest is paid out every 6 months.

10. Taxation

You will be charged a withholding tax on your gains. For the above bonds, the rate was 10%.

11. Redemption dates

This is the date the bond matures. On these dates, you will receive all the money you invested in the specific bond.

If you invested in the above bond, you’ll receive your investment amounts in 2029 and 2038.

12. Placing agents

These are licensed investment companies that also sell the bond. They charge a management fee if you invest through them unlike investing through CBK which is free.

A smart investor breaks through the chain of going through intermediaries as that costs money that would otherwise be used for investing.

13. Issuance Method (Multi price bid auction)

This means investors can submit their bids (applications) for different amounts (quantities), say you want to buy bonds worth 500,000 and another person may submit their bid for 100,000.

Also in a multi price bid auction, you can state the interest rate you want to be paid which will affect the price of the bond you’ll be awarded which could be different from another person.

This is referred to as a competitive bid and is open to investors with 20 million and above to invest. The system is rigged for the rich, no?

14. Non-competitive bids

In a non-competitive bid or application, the investor does not state a preferred interest rate.

Instead, they allow the average that will be reached at the auction to apply to their bonds as well.

If the auction determined rate is 10% the non-competitive bidder will go with that.

15. Bids closure

The deadline for placing your bid. For the above bond, the deadline was 9th March

16. Auction Date

This is the day The Auction Management Committee meets to decide which bids to accept and which to reject depending on the different cut off rates.

17. Results

The day investors are informed via text messages through the numbers used to register if their bids were successful or not.

18. Defaulters note

You can be banned from investing in fixed income securities if your bid is awarded, then you fail to make payment on time or completely.

Step 2: Choose the bond to invest in

Sometimes there’s more than one bond on auction, CBK wants you to be specific in picking that bond.

Step 3: Make an application to invest.

This is done through completing a Treasury Bond Application form

The Treasury Bond Application form has a few technical terms that you need to understand:

-

Maturity

The difference between the value date (when CBK starts counting the starting period) and when the bond reached the end of its tenor.

-

The Issue Number

Every bond, as explained earlier, has a special code that’s used to identify it.

Other information that you need:

- Personal information such as name, phone number, CDS number and source of your funds.

- Choose your preferred discount rate or return rate.

When picking the rates of return, you have 2 options:

1. Competitive bid

This is where you state your preferred rate of return, say 10%

2. Non-competitive or average rate

This is where you let the T-bond auction decide the rate of return/cut-off rate to assign to you.

This is the best option for beginners and those with investable funds of less than 20 million.

-

The final part is the rollover instructions.

This is for existing investors where they give CBK permission to roll over funds from their maturing bills & bonds to upcoming government securities. This makes reinvestment easier.

Step 4: Getting auction results

CBK’s Auction Management Committee (AMC) determines the cut-off rate and the successful weighted average of the accepted bids after considering all received bids.

The results of this auction are published in the daily newspaper & on the CBK website.

You should check the website or newspaper if you had placed a bid as you’ll need to send your investment money to CBK by the following Monday before 2 pm.

If Monday happens to be a public holiday, you have to send the money by the following day.

They will also send you an SMS to your registered mobile number that reads as follows:

Dear Investor, Auction Results for Treasury Bonds value date 12/4/2021 have been released. Go to https://bit.ly/31ThnJd for full information.

Note: The Auction Management Committee’s decision is final and cannot be contested.

Step 5: Making the payment to CBK

The payment period for your bid closes the following Monday before 2 pm.

You can pay via cash or cheque for amounts below 1 million. For amounts larger than 1 million, a bank transfer is used.

Note: You can be barred from future investments in government securities if you fail to make your payment by the deadline. Make sure you have ready money by the time you start the application process.

Step 6: Receiving your money!

You will receive interest payouts every 6 months. Your interest amount will be sent to your bank account that’s linked to your CDS account.

When the bond period is over you will receive your principal amount in your bank account that’s linked to your CDS account.

If you had given rollover instructions, your principal amount will remain in your CDS account until you bid for the next treasury bill or bond.

You give rollover instructions at the beginning of the investment through the application form as explained earlier.

Treasury Mobile Direct (CBK-TMD Code)

For a long time, investors complained about the cumbersome process explained above.

The CBK finally responded by launching a USSD mobile application which makes it easier and faster to invest in both T-Bills & Bonds at the comfort of your home, office, vacation etc!

What’s CBK-TMD and how to navigate the app

Central Bank of Kenya Treasury Mobile Direct (CBK TMD) is a USSD mobile system application that enables CDS account holders to buy treasury securities (treasury bills & bonds) and query their virtual account balances using the *866# short code on their mobile phones.

When your CDS account is set up, CBK will send you a text message on your registered mobile number.

This is a notification that you can start using TMD using the CBK USSD Code *866#.

When you dial the *866#, the interface will recognize you as a CDS account holder.

This is the process we recommend here at The Wealth Tribe. Use it to buy your first security!

How to buy a bond using TMD

Step 1: Dial *866#

Step 2: enter your PIN

Step 3: Select option 2-Auction Bids

Step 4: Select Security Type

Step 5: Select Security on offer

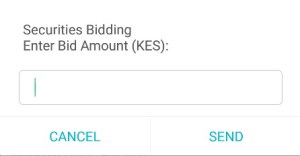

Step 6: Enter Bid amount

Step 7: Enter bid Rate (Enter 0 for average rate)

Step 8: Confirm and send

When your bid is accepted (you will receive a text message), you can proceed to make your payment.

You can pay via:

- Direct deposit at any bank

- Real-Time Gross Settlement (RTGS)

- Electronic Funds Transfer (EFT)

- Cheque

- Take cash to CBK if you wish; they’ll credit it.

When making a bank transfer, in the place of A/C number, put the virtual account number that CBK will send to you through email (e.g VIRTUAL ACCOUNT NO. 1000259781). When asked for a reference, write your CDS/Portfolio account number as provided by CBK ( e.g CDS/PORTFOLIO ACCOUNT NO. 123454-1)

When you log in to your CDS A/C, you should be able to see your credit reflected.

Why we love CBK-TMD!

TMD is accessible through all types of phones including kabambes. This makes it accessible to all Kenyans. You do not need a smartphone or internet connection to access TMD.

You will be able to access the following services at the touch of a button:

- Applying & bidding for T-Bills & Bonds

- Notifications of bid outcomes

- Your account balance

- Status of alerts for sales or purchases in the secondary market

The different sections of TMD App

Check the TMD brochure from CBK here.

Investing in the secondary market

Buying in the primary market means buying bonds directly from the government through the Central Bank of Kenya.

Buying in the secondary market involves bond investors buying from each other on platforms such as The Nairobi Securities Exchange.

Treasury bonds risk

Bonds are referred to as risk-free because the government can raise taxes or simply print more money to pay back the investors.

Are Treasury bonds a good investment?

1. Bonds are a predictable, medium term to long term source of income.

The investor receives interest payouts every 6 months

The interest rate is also locked for the entire tenor (life of the bond) which makes it easier to plan for your financial future.

2. Occasionally CBK issues tax-exempt bonds such as M-Akiba and other infrastructure bonds.

This makes investing in bonds a lucrative investment.

3. They’re liquid which is great for cash flows.

Bonds are liquid in that there is an active secondary market where you can sell your bonds anytime before maturity and get your money back. If you cannot get a buyer at the secondary market, you can always sell it back to CBK.

4. Bonds are a secure investment.

They’re backed by the full faith and credit of the Kenyan government.

5. Treasury bonds offer flexibility to suit different types of investors.

This is because the government offers different types of bonds.

6. They’re auctioned monthly

With a good financial plan, everyone can save and get an opportunity to invest.

7. Bonds can be used as a vehicle to plan for the perfect retirement

Since they’re medium term and long term investments, you can use them as one of your retirement investment funds.

8. You can use T-Bills & Bonds as credit collateral

You can use T-Bills & Bonds as collateral to obtain a loan from your local bank up to 80% of its Face Value

FAQs on Treasury Bonds

How do you know if your bid was accepted by CBK?

a) The Central Bank of Kenya will send you an SMS to your registered mobile number that reads as follows:

Dear Investor, Auction Results for Treasury Bonds value date 12/4/2021 have been released. Go to https://bit.ly/31ThnJd for full information.

b) If you don’t receive an SMS, you can send CBK an email via primaryissues@centralbank.go.ke and enquire if your bid was accepted.

c) Use CBK-TMD to check your CDS account balance by: Dialing *866#

Then go to Balance Enquiry

Then Payment Account Balance

Your balance should be 0 if your payment was credited. Otherwise, it will show you the amount due for payment.

Can I invest in Treasury Bonds while living in the diaspora?

Yes! Kenyans in the diaspora can follow the instructions in this document to start investing in Treasury Bonds.

The process of opening a CDS account used to be easier when done from the diaspora as CBK did not require Kenyans to submit hard copy documents. Unfortunately, this changed recently. You have to send your documents via courier to CBK.

The list of documents required:

1. Duly filled mandate card

2. Passport or ID copy

3. Email Indemnity Agreement form

4. Treasury Mobile Direct (TMD) Registration form if you have a Safaricom line that is roaming

5. One passport photo

6. KRA pin certificate

7. Central Bank of Kenya Treasury Mobile Direct Terms & Conditions form

Contact CBK to email you the Email indemnity agreement, TMD registration form and the CBK TMD terms & conditions form.

From experience, call them instead of emailing them. Their emails either bounce or they never reply.

When done, send your documents via courier to:

The Director

Financial Markets

Central Bank of Kenya

P O Box 60000- 00200

Nairobi.

Treasury Bonds Pricing Calculator

Both the pricing calculator and the rediscounting calculator can be found at the bottom of this page.

Treasury bonds vs corporate bonds

Treasury bonds are issued by the government of Kenya through CBK & brokers while corporate bonds are issued by companies through brokers.

Tax-exempt treasury bonds

Some infrastructure bonds are tax exempt. This is usually specified in the specific bond prospectus.

The M-Akiba bond is also tax-exempt.

How often do Treasury bonds pay interest?

Semi-annually (every 6 months)

Are treasury bonds liquid?

Yes, they are in that there is an active secondary market where you can sell your bonds anytime before maturity and get your money back. If you cannot get a buyer at the secondary market, you can always sell it back to CBK.

Do Treasury bonds compound interest?

Treasury bonds returns are calculated using simple interest and not compounding interest.

Do bonds have default risk? Has it ever happened in Kenya?

Default risk is almost non-existent in that the government can even print money to pay you.

Whenever an instrument is maturing and the government has no ready money to redeem it, they can lengthen its tenor and continue paying you interest or give you an option to hop into another instrument. However, this rarely happens.

T-Bonds are backed by the full faith and trust of the Kenyan government.

Conclusion

You officially have one more medium term to long term investment opportunity to explore! Go forth and build wealth!

Was this article useful? If yes, mind leaving us a Tip through this link to help us keep this blog alive? You can pay what you believe this article is worth to your financial freedom journey…it could be 10 shillings, could be 5,000 – you decide.

Do you have any more questions about investing in T-Bonds? Tell us in the comment section below. We love hearing from the tribe!

Latest posts by Agatha (see all)

- How The Vuka Investment Club Platform Works + How To Buy And Sell Units Of The Acorn I-REIT On The Vuka Platform - July 19, 2023

- How To Use Cashlet App To Create Sinking Funds For Beginners In 5 Easy Steps - July 7, 2023

- June 2023 Infrastructure Bond: Bond Redemption Structure & Amortization - June 12, 2023

- What Is Your Net Worth? How To Calculate Your Net Worth In 2 Easy Steps & Why It Matters - April 13, 2023

A very informative article! Thanks for sharing such valuable information and encouraging one to invest directly with CBK. Looking forward to more informative articles from you!

Thank you Dipesh! I’ll keep writing more insightful articles!

Hi Agatha wanted to ask if may bebai have invested on the 15 year bond and I want to top up some money every month is it possible?

Hi Shen, unfortunately, CBK doesn’t have that provision. You can’t do monthly top-ups on a bond.

Here’s how the rollover works:

To roll over means to extend the maturity date of a loan or to reinvest funds from a maturing security in the same or similar security.For example, reinvesting the interest earned in a Money Market Fund, instead of withdrawing it.

You can also roll over the interest due, principal or both principal and interest in a new or re-opened bond issue.

Investors who choose to roll over their securities have to complete an application form giving rollover instructions and submit to the Central Bank. The maturity date of the maturing Treasury bond or bill MUST match for rollover instruction to be successful.

Unless you have loads of money to invest, the whole process is just cumbersome. Just invest your money in new bonds since they’re auctioned monthly.

Thanks Agatha for this very informative article. I have two questions

1. How I know when the government announces the next Fixed Coupon Treasury bond? I can see that the period of sale is brief and I would like to be in time

2. Kindly clarify the roll over aspect. If for example I invest 100,000 with a coupon rate of 10% p. a after WHT, I should be receiving 5,000 every six months and my 100,000 after the end of the tenor. If I issue ‘roll over instructions’ how does this work? Is there a way I can instruct the government to reinvest the interest (10,000 p. a) such that I receive it together with the principal at the end of the tenor?

To ensure that you send the money required to buy the bills or bonds to CBK on time, can you send it prior to winning a bid?(this should be similar to people rolling over their principal)

You can, your money will be safe in your CDS account. Just that it won’t be earning anything.

Eye opening information, Learned a lot I didn’t know and soon will be investing in bonds. Thanks so much.

Welcome, and all the best in your investing journey 💵

Thank you, this was very informative!

Could you please clarify on YTM and Clean Price in reference to the fixed coupon rate? How exactly do they affect my investment and interest?

An example would work just fine 🙂

Very helpful

🤑

Very informative and detailed, you are doing a great job, glad to be here.

Thank you Nush, welcome to The Wealth Tribe 💰

The article is very impressive. Very informative and well presented.

Thank you, Derrick!

Hi Agatha. Well done A very nice piece.

1. When paying for Bonds which CBK account number do you transfer funds to and which of the two account number references below do you quote?

CDS/PORTFOLIO ACCOUNT NO. 123454-1 VIRTUAL ACCOUNT NO. 1000259781

2. What’s the process of selling the bond in the secondary market or back to CBK?

Hi David,

When making a bank transfer, in the place of A/C number, put that virtual account number (VIRTUAL ACCOUNT NO. 1000259781). When asked for a reference, write your CDS/Portfolio account number (CDS/PORTFOLIO ACCOUNT NO. 123454-1)

When you log in to your CDS A/C, you should be able to see your credit reflected.

To sell a bond in the secondary market, contact your stock broker.

Thanks Agatha. This s so informative for a beginner. I really benefited. Asante.

Karibu sana Wangari.

Thank you for this great article, I would like to get to know more about this

Hi Rinooh, I’m here to help. I’ll drop you an email and we can schedule a call.

So impressed by your article on investing with T.bill and Bonds. Your content is quite articulate and informative for Kenyans wherever they are. Keep up the good work as I look forward to reading more of your posts and guids.

Thank you, Peter!

Firstly want to commend you for this great article. It has inspired me and I have been able to invest in my first ever government bond.

Secondly, how do I support your work?

Thirdly ,you have mentioned being able to login in your CDS account. How is this done?

Thank you

Hi Faith, congratulations on taking action!! I’m so proud of you for reading and investing. Cheering you on! On supporting my work, I’ll send you an email with a link. To login to your CDS account, dial *866# and follow the prompts.

Hello!I found this quite elaborate and my interest in investing in Bonds has doubled.Thankyou very much

I’m glad you found value in the article. Welcome, Vivian 😊

Hi Agatha,

Thank you so much for your helpful article.

I’ve read so many pieces on Treasury Bonds and yours is the first that discussed the terms of the bonds in detail and I’ve learned a lot.

My question is about the term Price Quote (Discounted, Premium, Par) – how do I know if a bond will be discounted, at par, or offered at a premium? I’ve tried reading the prospectus and result documents to no avail.

Thank you in advance for your help 🙂

GREAT INSIGHTS & VERY HELPFUL. THANK YOU AGATHA & TEAM

Karibu

This is a very in-depth article. I work in the capital markets industry and one of our key agendas is investor education but I always struggle finding information online about investing in Kenya. Nice work!

On a light(not-so-light) note, you are the people Ruto is looking for to educate the mama mbogas and bodaboda guys on financial literacy!

May your prayers be answered!