Did you know there’s another way you can contribute towards funding your government’s projects apart from through paying taxes? You can loan money to your government. When you do, the government will pay you back all your money plus interest!

You can do this by investing in Fixed Income Securities.

As shown in the flow chart above, there are two types of Fixed Income Securities:

- Treasury Bills

- Treasury Bonds

They’re referred to as fixed-income securities because the return the investor gets is usually paid out in fixed interest payments on fixed dates over a fixed period of time.

If you’re a visual learner, we have a visual version of this on our YouTube Channel:

Key Differences between Treasury Bills & Treasury Bonds

For the ultimate guide on investing in treasury bonds, click here.

For the ultimate guide on investing in treasury bonds, click here.

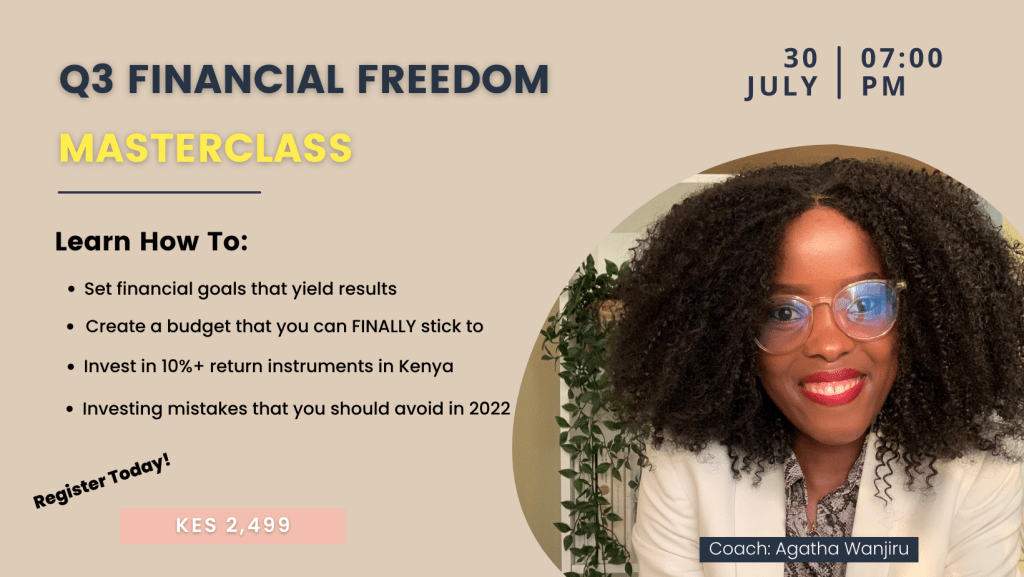

In this article, you will learn everything you need to know about Treasury Bills (T Bills) after inviting you to The Wealth Tribe’s Q3 Financial Freedom Masterclass

Drum rolls, please…Tadaaaa!!! 🥳

On Saturday 30th July from 7 to 9:30 pm, I will be teaching everything you need to know about these foundational money topics that are crucial for your long-term financial success:

✅ How to set financial goals that yield results.

✅ How to create a budget that you can finally stick to.

✅ How to invest in 10%+ return instruments in Kenya.

✅ Investing mistakes that you should avoid in 2022.

The masterclass will feature both step by step instructions and a live Q&A.

You’ll also get a practical exercise at the end of the webinar so that you can start building your financial foundation with the FREE tools I’ll provide.

These tools are:

☑️ FREE Budget Tracker

☑️ FREE Sample investment portfolio

☑️ Access to The Wealth Tribe community.

The masterclass will be delivered via Zoom; the access link will be shared as soon as I receive your payment.

Sounds good?

But…

How much does that Masterclass cost?

Ksh 2,499

There are 2 ways to Book Your Slot:

A. Pay in 3 installments (KES 833 for each installment)

Paybill: 522522

Account: 1291180729 (This is The Wealth Tribe’s KCB Account Number)

B. Pay In Full Now Using This Link

At Checkout, use the Discount Code: TheWealthTribe for 10% OFF

What is a Treasury Bill?

A Treasury Bill, often referred to as a T-Bill is a short-term, fixed-income security issued by the government through The Central Bank of Kenya (CBK).

Types of Treasury bills in Kenya

Treasury bills are classified based on their maturities.

There are 3 types of Treasury bills that you can buy in Kenya:

- 91-day T bills

- 182-day T bills

- 364-day T bills

The longer the T-bill period, the higher the returns (interest rate). This means a 364 day T-bill will give you higher returns as compared to the 91-day T-bill.

How much are T-Bills? How much money do you need to start investing in Treasury Bills?

You need a minimum of KES 100K to start investing in T Bills.

This is a large amount of money for a beginning investor which poses a barrier to entry unlike investing in Money Market Funds where you can begin investing with as little as KES 2,500.

If you cannot raise the KES 100,000 don’t despair. Baby steps is the way to go! Start with a Money Market Fund then onboard Treasury bills & bonds in your investment portfolio later.

Note: Money Market Funds also invest in T-bills thereby giving investors indirect ownership of T-bills at a fractional amount.

How T-bills work in Kenya

Instead of investing your KES 100,000 shillings and getting X% in interest after a certain period of time, treasury bills are sold at a discount to the face value and redeemed at face value at maturity.

For example, a 100k (face value) bill may be sold at 95k (this is the amount you’ll pay).

At the end of the period (91, 182 or 364 days depending on the bill you chose) you get the full 100k.

The 5,000 return in the above example is subject to 15% withholding tax.

Note: Don’t be alarmed about the technical term ‘face value’. I will explain all the technical terms at the end of this article. For now, keep the above example in mind. We’ll revisit.

How often are treasury bills auctioned/issued in Kenya?

T bills are auctioned by the Central Bank of Kenya on a weekly basis.

Why the government issues T-Bills

The government issues T-bills as a way to raise money to fund its various projects. If you ever read the government budget, issuance of T-bills and T-bonds is collectively referred to as domestic borrowing by the government.

How to buy T-Bills

To buy Treasury bills, you need a Central Depository for Securities (CDS) account maintained at the Central Bank of Kenya.

This is different from the CDSC (Central Depository Securities Corporation) account that you need to buy equities/shares.

Requirements for a CDS account

1. Complete a CDS account application (referred to as a Mandate Card) form issued by CBK.

You can get this form from any CBK branch countrywide. You can pick this card from the branches on any weekday before 2 pm.

2. One recent coloured passport size photograph.

The back of the photograph MUST be certified by your Banker and stamped. The passport photo shouldn’t be stapled or glued to the card.

3. The original and clear ID or passport copy or alien certificate.

CBK will retain the copies.

4. A signatory

Your banker should witness and confirm your signature on the mandate card. He/she should also stamp and sign your mandate card.

Central Bank Guidelines for filling the CDS application form (Mandate card)

- Should be filled in BLOCK LETTERS in a neat and clear manner.

- Names must be written in the order they appear in your identification document.

- There should be no corrections or errors.

- Don’t fold the card or disfigure it in any way.

For a joint account:

- Each applicant should fill the application form (mandate card).

- All signatories are required to appear in person and sign the card in the presence of a designated CBK officer or authorised agent.

- All other guidelines above apply to joint account applicants.

Can you get a second form if you mess up one? When you go to CBK, collect at least 3 forms so that you have an extra one if you mess up. You can also share the other forms with your family, friends or colleagues. Wealth building is better when your whole tribe is winning!

How to open a CDS account

1. Return the filled mandate card and the documents to CBK.

You’ll be directed to a counter where your application will be received by an officer and checked for compliance.

2. Once your account is set up, you will be sent an email by the National Debt Office which reads like this:

Dear Investor,

CONFIRMATION OF UPDATE ON CDS ACCOUNT

We have processed your application for amendment of your CDS account details held in our books as per your recent request and confirm that we have affected the changes as requested.

CDS/PORTFOLIO ACCOUNT NO. 123454-1

VIRTUAL ACCOUNT NO. 1000259781

Please note that CDS accounts without balances for a period of one year automatically become dormant.

When transacting always quote CDS/Portfolio account number in Treasury Bill/Bond primary tender applications or any other correspondence. Also while making payments for investments in Government Securities, send the funds to your Virtual account number as given above.

In the event of any change in your bank/branch details or reactivation of a dormant account, you are required to complete new mandate cards to effect the change in your CDS account.

Yours faithfully,

CDS SECTION

Monetary Operations & Debt Management (MODM)

Financial Markets Department

Central Bank of Kenya

Note: To prevent your CDS account from becoming dormant, ensure that there is always a security (either T-bill or T-bond) running in your account.

It takes 7 working days to process your application at the CBK.

Where to buy Treasury Bills

Once your application is approved, the next step is to start investing in Treasury bills. There are two ways you can buy Treasury bills:

1. Directly through the Central Bank of Kenya (manually or through CBK-TMD USSD Application)

2. Through approved investment companies such as

- Commercial banks

- Non-bank financial institutions

- Licensed stockbrokers

- Licensed investment advisors.

These investment companies charge you management fees (a portion of your investment capital).

A smart investor breaks the chain of going through intermediaries which is why investing directly through CBK is the best option and the only option we’ll teach you in this article.

Here are the steps to follow when investing through CBK.

Step 1: Check the Treasury Bills on offer on the CBK website.

Remember that these are auctioned on a weekly basis so they keep changing.

The screenshot below shows the Treasury bills on offer as of 07th March 2021.

Step 2: Select a Treasury Bill of your choice based on your preferred investment period.

You have three options: 91 day, 182 day & 364 day T-bills.

The CBK website has a listing of the upcoming offers, and results of the previous offers. Taking time to check the previous auction results gives you a good guide on the kind of returns to expect. You can see that information here.

Step 3: Make an application to invest.

This is done through completing a Treasury Bill Application form

The Treasury Bill Application form has a few technical terms that you need to understand:

- Face value

This is how much the bill is worth. It is also referred to as the par value.

In the example we used at the beginning of the article, the face value is KES 100,000.

- Discount

In our example, the discount for the KES 100,000 T-Bill where you pay 95,000, is 5%.

5,000/100,000 = 0.05

0.05*100 = 5%

- Maturity

The difference between the value date (when CBK starts counting the starting period) and when you get your money. So this period is either 91, 182 or 364 days.

- The Issue Number

Every T-Bill has a special code that’s used to identify it. In the screenshot above from the CBK website, the issue number for the 91-day bill is 2412/091.

Now that you know what all the technical terms mean, let’s go back to step 3 of filling the Treasury Bill application form…

- You’ll need to fill in the issue number, the maturity period and the face value you want to receive when the bill matures.

- Personal information such as name, phone number, CDS number and source of your funds.

- Choose your preferred discount rate or return rate.

When picking the rates of return, you have 2 options:

1. Competitive bid: This is where you state your preferred rate of return, say 10%

2. Non-competitive or average rate: This is where you let the T-bill auction decide the rate of return/cut-off rate.

This is the best option for beginners and those with investable funds of less than 20 million.

- The final part is the rollover instructions.

This is for existing investors where they give CBK permission to roll over funds from their maturing bills & bonds to upcoming government securities. This makes reinvestment easier.

Step 4: Getting auction results

CBK’s Auction Management Committee (AMC) determines the cut-off rate and the successful weighted average of the accepted bids after considering all received bids.

The results of this auction are published in the daily newspaper & on the CBK website.

You should check the website or newspaper if you had placed a bid as you’ll need to send your investment money to CBK by the following Monday before 2 pm. If Monday happens to be a public holiday, you have to send the money by the following day.

They will also send you an SMS to your registered mobile number.

Note: The Auction Management Committee’s decision is final and cannot be contested.

Step 5: Making the payment to CBK

The payment period for your bid closes the following Monday before 2 pm. You can pay via cash or cheque for amounts below 1 million. For amounts larger than 1 million, a bank transfer is used.

Note: You can be barred from future investments in government securities if you fail to make your payment by the deadline. Make sure you have ready money by the time you start the application process.

Step 6: Receiving your money!

You will receive the face value amount in your bank account that’s linked to your CDS account when the 91, 182 or 364 period is over.

If you had given rollover instructions, your principal amount will remain in your CDS account until you bid for the next treasury bill or bond.

Your interest amount will be sent to your bank account.

You give rollover instructions at the beginning of the investment through the application form as explained earlier.

Treasury Mobile Direct (CBK-TMD Code)

For a long time, investors complained about the cumbersome process explained above.

The CBK finally responded by launching a USSD mobile application which makes it easier and faster to invest in both T-Bills & Bonds at the comfort of your home, office, vacation etc!

What’s CBK-TMD and how to navigate the app

Central Bank of Kenya Treasury Mobile Direct (CBK TMD) is a USSD mobile system application that enables CDS account holders to buy treasury securities (treasury bills & bonds) and query their virtual account balances using the *866# short code on their mobile phones.

When your CDS account is set up, CBK will send you a text message on your registered mobile number. This is a notification that you can start using TMD using the CBK USSD code *866#.

When you dial the *866#, the interface will recognize you as a CDS account holder.

This is the process we recommend here at The Wealth Tribe. Use it to buy your first security!

How to buy a T-Bill using TMD

Step 1: Dial *866#

Step 2: enter your PIN

Step 3: Select option 2-Auction Bids

Step 4: Select Security Type

Step 5: Select Security on offer

Step 6: Enter Bid amount

Step 7: Enter bid Rate (Enter 0 for average rate)

Step 8: Confirm and send

When your bid is accepted (you will receive a text message), you can proceed to make your payment.

You can pay via:

- Direct deposit at any bank

2. Real-Time Gross Settlement (RTGS)

3. Electronic Funds Transfer (EFT)

4. Cheque

5. Take cash to CBK if you wish; they’ll credit it.

When making a bank transfer, in the place of A/C number, put the virtual account number that CBK will send to you through email (e.g VIRTUAL ACCOUNT NO. 1000259781). When asked for a reference, write your CDS/Portfolio account number as provided by CBK ( e.g CDS/PORTFOLIO ACCOUNT NO. 123454-1)

When you log in to your CDS A/C, you should be able to see your credit reflected.

Why we love CBK-TMD!

TMD is accessible through all types of phones including kabambes. This makes it accessible to all Kenyans. You do not need a smartphone or internet connection to access TMD.

You will be able to access the following services at the touch of a button:

- Applying & bidding for T-Bills & Bonds

- Notifications of bid outcomes

- Your account balance

- Status of alerts for sales or purchases in the secondary market

The different sections of TMD App

Check the TMD brochure from CBK here.

Are Treasury Bills taxable in Kenya?

Yes. Your gains are subject to a 15% withholding tax.

You receive your money less the 15% withholding tax. CBK is an authorised withholding agent by Kenya Revenue Authority (KRA).

How much Treasury bills can I buy?

As stated earlier, the minimum amount you need to buy treasury bills is KES 100,000.

If you choose a non-competitive or average rate, the maximum is 20 million.

Can I invest in Treasury Bills while living in the diaspora?

Yes! Kenyans in the diaspora can follow the instructions in this document to start investing in Treasury Bills. Invest at home 😉

The process of opening a CDS account used to be easier when done from the diaspora as CBK did not require Kenyans to submit hard copy documents. Unfortunately, this changed recently. You have to send your documents via courier to CBK.

The list of documents required:

1. Duly filled mandate card

2. Passport or ID copy

3. Email Indemnity Agreement form

4. Treasury Mobile Direct (TMD) Registration form if you have a Safaricom line that is roaming

5. One passport photo

6. KRA pin certificate

7. Central Bank of Kenya Treasury Mobile Direct Terms & Conditions form

Contact CBK to email you the Email indemnity agreement, TMD registration form and the CBK TMD terms & conditions form.

From experience, call them instead of emailing them. Their emails either bounce or they never reply.

When done, send your documents via courier to:

The Director

Financial Markets

Central Bank of Kenya

P O Box 60000- 00200

Nairobi.

Treasury Bills Pricing Calculator

Both the pricing calculator and the rediscounting calculator can be found at the bottom of this page.

How to use treasury bills

1. Since Treasury bills are short term in nature, you can use them to accumulate investment capital that you will later use in bigger and more lucrative investments.

Treasury bills returns are calculated using simple interest and not compounding interest.

2. To remove the temptation of spending money by having it in a current account, invest it in a Treasury Bill.

Why invest in Treasury Bills?

1. Diversification of your investment portfolio.

Remember the rule: don’t put all your eggs in one basket!

2. T- Bills are a low-risk investment

If you’re a beginner in investing or are risk-averse, then investing in Treasury bills is a perfect option. T-bills and bonds are considered to be the least risky investments in Kenya.

3. Capital preservation

You don’t want your money to sit in a current account or under your mattress where it will lose value due to inflation. Preserve the value of your capital by investing in T-bills

4. No management fees

The biggest risk to most investors portfolios is management fees or the cost of managing their investment portfolios charged by fund managers.

Investing in T-bills directly through CBK as opposed to investing through other financial institutions is free.

Are T-Bills risk-free?

They are risk-free in that they are backed by the full faith and credit of the Kenyan government.

Are T-Bills liquid?

T-bills are the most liquid in that cash for alternative investments is tied for a short time. Cash flow is king!

Conclusion

You officially have one more investment opportunity to explore! Go forth and build wealth!

Was this article helpful? If yes, mind leaving us a Tip through this link to help us keep this blog alive? You can pay what you believe this article is worth to your financial freedom journey…it could be 10 shillings, could be 5,000 – you decide.

Do you have any more questions about investing in T-Bills? Tell us in the comment section below. We love hearing from the tribe!

Latest posts by Agatha (see all)

- How The Vuka Investment Club Platform Works + How To Buy And Sell Units Of The Acorn I-REIT On The Vuka Platform - July 19, 2023

- How To Use Cashlet App To Create Sinking Funds For Beginners In 5 Easy Steps - July 7, 2023

- June 2023 Infrastructure Bond: Bond Redemption Structure & Amortization - June 12, 2023

- What Is Your Net Worth? How To Calculate Your Net Worth In 2 Easy Steps & Why It Matters - April 13, 2023

Very insightful article. I have been post poning the trip to CBK and it’s a relief to know I can do it on my phone.

Just a clarification, so the interest you earn is the ‘discount’ or is the something else on top.? In the example if 95k for 100k face value… The 5000 is my take home? Or is it 5000 plus some more interest?

Yes. For T-Bills, the discount is the interest. And yes, the 5,000 is your take-home; subject to a 15% withholding tax.

So if I put my Tbill for 91days, how will I be able to transfer amount from the virtual account to my personal account if I need to remove some amount

CBK will send the money to your bank account when the T-Bill matures

I am so enlightened.I never knew all these You are the best mwaaa.For sure lazma nitume kitu for appreciation

Asante sana! Will appreciate the token.

Very informative article. The fact that you can invest in T-bills straight off your phone is transformative.

Thank you Agatha !

😂😂😂😂😂😂 sigh

What if I forget the pin to *866# is there a way to retrieve it?

Contact CBK. Check their website for their customer care number.

Thank you very much for the informative and educative article.

Questions.

1. Can sacco shares be converted or transferred to T- Bills?

2. Can part of monthly salary be remitted to CDS account or top up minimum face value?

3. Can my savings in other financial institution transferred to CDS account?

@Shaban the answer to all your questions is no. You have to transfer the money to your CDS account after your bid has been accepted.

Hello is the 15% deducted from my interest or the whole amount??

interest

You say that the ‘face value’ will be paid to my account after the term of the T-BILL. Do you mean my CBK account or the bank i used to to send money to buy the T-bills, such as my Barclays Bank?

Your bank account, in this case, your Barclays

Hi! Just read this article! Very informative!

Q: is the 5% interest for the 90 days one and the 365 days one. Or the longer one has more interest?

Hi Jacky, that was just an example. The longer the Treasury bill, the higher the return. For example, 364 day Treasury Bills are now returning up to 13%!

Hello Agatha,

Thank you and quite an informative read. Quick question what is the incentive of letting your money stay for the 365 days instead of lets say 90 days. Is the difference between the actual value and face value that big if you let your money stay for a longer period instead of a shorter one?

The longer the maturity of a Treasury Bill, the higher the interest earned. This means that a 364-day T-Bill will earn you more than a 91-day Treasury bill: it’s a rule in finance, the longer you’re invested, the more interest you should make because you’re exposing yourself to more risk.

Thanks so much for that information. now if one has a CDS account already, is he/she required to create another specifically for T/Bills or the existing is enough?

One is enough: we use one CDS account for both bonds and bills

Very informative, How can I register for my pin because I went back abroad. when I use the *866# its an invalid MMI code since I’m roaming.

Which pin are you referring to?

Hi Agatha, after paying cash to cbk for the treasury Bills how do I know my account is active?

Also after payment what should I expect to see?

Hi Macadaa, I will create a guide on YouTube on this soon!